BOARD OF ASSESSMENT APPEALS ON WEDNESDAY SEPTEMBER 6, 2023 AT 6:00 PM LOWER LEVEL CONFERENCE ROOM!

This is ONLY for vehicles on the 2022 Grand List

Appeals will be heard on a first come, first served basis

The Board of Assessment Appeals is designed to serve as an appeal body for taxpayers who believe that town assessors erred in the valuation of their properties or erroneously denied them exemptions. It is a review body, and as such serves independently of assessors.

The Board of Assessment Appeals may:

- Correct clerical omissions or mistakes in assessments.

- Add to the assessment lists the names of people who own taxable property in the town, but have been omitted from the lists.

- Increase the number, quantity or amount of the property in any person’s list.

- Reduce the list of any person appearing before the Board by decreasing the valuation, quantity or amount of any item.

- Make a supplemental list of any taxable property omitted by the assessors.

- Shall add 25% to the value of any additions or supplemental lists of personal property.

- Administer oaths in cases coming before them.

- Elect not to conduct appeal hearings for any commercial, industrial, utility or apartment properties with assessment greater than one million dollars.

Appeal Process:

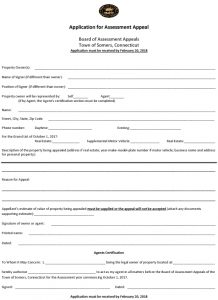

Taxpayer must make a written application on or before February 20, or March 20, if the Assessor has received an extension for the filing of the Grand List, and, at one of the meetings, offer or consent to be sworn in and give facts required by the Board.

Board Members:

| Name | Position | Term Expires |

| Francis W. Devlin, Jr. | Chairman | 12.22.2022 |

| Keith Burger | Member | 12.22.2024 |

| Della Froment | Member | 12.22.2023 |

The Board meets in March to hear appeals, or April if the assessor was granted an extension for filing the Grand List. The Board also convenes at least once in September solely for motor vehicle assessment appeals.

Forms:

PP LONG FORM 2021 PP SHORT FORM 2021Staff liaison:

Karen Neal

Phone: (860) 763-8202

Email: kneal@somersct.gov

This Board/Commission is aligned with the Finance Department.