Hours: Monday – Wednesday: 8:00 am – 5:00 pm Thursday: 8:00 am – 6:30 pm

Friday: Town Hall is Closed

Address:

600 Main St Somers, CT 06071

Phone: 860-763-8210 Fax 860-763-8228

Staff:

| Alissa Hanvey | Tax Collector | Ext 8209 | [email protected] |

| Patricia (Trish) Thomas | Tax Clerk | Ext 8208 | [email protected] |

__________________________________________

All Sewer User Fee questions can be directed to Dan Parisi of WPCA at [email protected]

Any questions on your tax bills (i.e. What is this for? I don’t have this car anymore! Where is my exemption?) can be directed to 860-763-8202. Please note these bills are based upon October 1, 2024.

__________________________________________

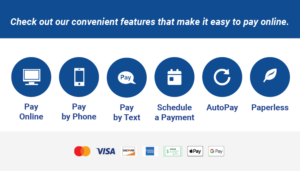

Pay / View Taxes Online Here:

You can now pay your sewer user bill on line here!

Service Fees apply to all payments in person or online: There is a 3.25 % convenience fee charged to you from the credit card companies, minimum fee of $1.95. If you pay with an Electronic Check, the fee is 95 cents.

To pay by phone call 855-725-0893. You will need a bill number (s). There is an additional fee to pay by phone.

The fees for all online and telephone payments and are paid directly to the Credit Card Merchant Vendor. The Town does not make a profit off these fees.

Please note, the Town of Somers is separate from Department of Motor Vehicles of Connecticut. An online payment does not automatically release a DMV hold at the time of the payment. All payments are posted the next business day, and then the releases are sent nightly on normal business days to the DMV. Therefore, all payments made Thursday through Monday (unless there is a Holiday), will be released Monday overnight (around midnight) at DMV. All other online delinquent payments will be released around midnight at DMV the following day of your payment. If you need an immediate release, please contact our office at 860-763-8210 after your payment has been made online. We will gladly assist you. Thank you.

You can get the amount you paid in town taxes for 2024 here: 2024 IRS Amounts (Please note we can not give this amount over the phone) The bills PAID in 2024 will have a BILL NUMBER that starts with 2023 and/or 2022.

You can use the online system to schedule payments, enroll in Pay By Text and enroll in Auto Pay. You may set up Auto Pay for your real estate and personal property taxes online. Motor vehicle taxes have a new account each year, so they will not be automatically added to Auto Pay each year. You will have to add motor vehicles to your online account each year.

Can I pay my taxes in Town Hall?

Town Hall is open, but for the safety of our taxpayers and staff, payments are requested to be mailed, or placed in either the Drop Box in the Tax Office or the one outside the Front Door. You may also pay online. We do not accept payments over the phone.

When will the next Tax Bills be sent?

Tax Bills will be mailed on June 26,2025 for the 2024 Grand List. The due date for these bills is July 1,2025 and January 1, 2026.

The last day to pay without penalty for the 1st installment is Friday, August 1, 2025.

Interest will still be charged after August 1st at a rate mandated by the State of 1.5% per month, or 18% per year from the due date of July 1, 2025. This means, on August 1st, if you have not paid your first installment of the 2024 Grand List bill, you will be charged 3% interest (2 months due). Please note interest cannot be waived or adjusted.

What if I Receive a Tax Bill for a Motor Vehicle I No Longer Own?

The motor vehicle bill you receive in June 2025 is based upon registration of that vehicle effective October 1, 2024. With the proper proof, your motor vehicle bill may be deleted if the motor vehicle was disposed of prior to October 1,2024 or pro-rated if disposed of between October 2, 2024 and August 31, 2025. “Disposed of” includes sold, destroyed or registered out of state and not replaced with another vehicle using the same license plate. You need to submit proof to the Assessor’s Office as soon as possible to ensure credit prior to the penalty period.

In order to obtain a correction or pro-ration toward any motor vehicle assessment, you must submit two forms of proof to verify the property is no longer located in Somers under your ownership. In accordance with §12-71c(b), application for credit must be made by the December 31st two (2) years after the assessment date in which the credit situation occurred.

If you have any questions regarding the required proof, please contact the Assessor’s Office @ 860-763-8202.

Please note: The only time that the DMV notifies us of a change in the status of your motor vehicle is when you transfer a plate from one vehicle to another. In all other cases, you must bring documentation to the Assessor’s Office, in order to adjust your bill. The date must appear on the document that this change occurred in order to credit your account properly. All changes will occur immediately upon receipt of this information and a refund form or adjusted bill will be created. You may also fax this information to 860-763-8228 or email it the Assessor at: [email protected] or [email protected].

Why did I receive a Collection Agency (TaxServ) letter?

If you had an older delinquent account, or our office could not find you, your account was sent to the Collection Agency. They now have your account. All questions are to be addressed directly to them at 860-724-9100 or 866-497-2427. Their office is open from 8:30 am to 5:00 pm, Eastern time, Monday through Friday. You may also visit their website www.taxserv.com.

Why did I receive a letter from the Marshal?

The first week of May we will issue Alias Tax Warrants on most people that received a Demand Notice in April, that are not currently in the Tax Sale process or at the Collection Agency. These accounts are not available to be paid oline, for you must pay State Marshal Tim Poloski directly by calling him at 860-508-6566.

What is a Motor Vehicle Supplemental Bill? – mailed every December

These bills will be generated and due January 1, 2026 because you received a new motor vehicle registration, or have transferred an existing registration, at some time after Oct. 1, 2024, but before Sept. 30, 2025. You are being billed only for the number of months from your new vehicle registration date until the end of the assessment year.

THIS BILL DOES NOT REPLACE, but it is in ADDITION to, YOUR ORIGINAL SECOND INSTALLMENT OF MOTOR VEHICLE TAXES.

SEWER BILLS

Sewer Usage bills were mailed September 29, 2024. This bill covers October 1, 2024 to September 30, 2025. This bill is due by October 1, 2024 and becomes delinquent after November 1, 2024. Liens will be filed in June 2025 for all delinquent Sewer Accounts. All delinquent Sewer Accounts will be sent to the Marshal in June 2025. Pay Sewer Bills Here!

Why did I receive a Tax Collector’s Demand Notice?

If you have any outstanding tax bills, you received a Demand Notice (unless your account is already with the Tax Sale Attorney, Collection Agency or State Marshal) the beginning of April 2025.

So what does this mean?

You had until the Demand Due Date listed on your Demand to pay your delinquent taxes. If you fail to pay by the due date, the Tax Collector MAY (included, but not limited to):

- Serve an Alias Tax Warrant through a Marshal

- Send to a Collection Agency that records the delinquency to the Credit Agencies

- Levy your taxable goods or chattels

- Enforce by levy and sell their real estate through either a Tax Sale or Third Party

- Garnish Wages

- Bank execution – take the money from your bank account

The Demand Notice is the legal document required to send by the Town if we wish to pursue alternative means of collecting tax.

What is a Demand Notice?

Per State Statute 12-155. Demand and levy for the collection of taxes (a) If any person fails to pay any tax within thirty days after the due date, the collector or the collector’s duly appointed agent shall make personal demand of such person therefor or leave written demand at such person’s usual place of abode or addressed to such person at such person’s last-known place of residence. If such person is a corporation, limited partnership or other legal entity, such written demand may be sent to any person upon whom process may be served to initiate a civil action against such corporation, limited partnership or entity.

(b) After demand has been made in the manner provided in subsection (a) of this section, the collector for the municipality, alone or jointly with the collector of any other municipality owed taxes by such person, may (1) levy for any unpaid tax or any unpaid water or sanitation charges on any goods and chattels of such person and post and sell such goods and chattels in the manner provided in case of executions, or (2) enforce by levy and sale any lien upon real estate for any unpaid tax or levy upon and sell such interest of such person in any real estate as exists at the date of the levy for such tax. A lien is a charge upon real or personal property for the satisfaction of debt. Tax liens are superior to mortgage liens, and are independent of demand for. Liens remain in effect until all taxes, interest and fees are paid in full. Liens are subject to foreclosure, tax sale and sale/assignments to a third party for collection.

What is the Criteria for a Tax Sale or Lien Assignment?

- For a residential property, if you owe more than $3,000 in either Real Estate Taxes and/or Sewer Taxes, or are more than two Grand List years in arrears, you will be identified for a tax sale / lien assignment

- If the property has previously been in a Tax Sale, and becomes one (1) day delinquent

- If the property is abandoned or has no residential dwelling, and you are over one year in arrears

- Commercial properties over one year in arrears

A Tax Sale yet to be planned. A property listing can be found here: http://cttaxsales.com/upcoming-tax-sales/

PDF of listings: https://www.somersct.gov/wp-content/uploads/2022/12/Tax-Sale-Packet.pdf

My accounts went to the Tax Sale Attorney. Now what?

All questions and pay off quotes need to be addressed directly to Attorney Adam Cohen at 203-330-2230. The Tax Office cannot answer any questions about accounts in the Tax Sale process. Information on CT Tax Sales can be found at www.cttaxsales.com.

| July 1 | Real Estate tax 1st installment; Personal Property tax in full; Motor Vehicle tax 1st installment * |

| Oct 1 | WPCA Sewer tax in full |

| Jan 1 | Real Estate tax 2nd installment; Motor Vehicle tax 2nd installment; Motor Vehicle Supplemental tax in full, only if applicable. |

*Motor Vehicle tax bills over $500.00 have two installments.

Town of Somers Current Mil Rate for 2024 Grand List: 30.21

For the Towns Mill Rate History Click: Mill Rate History June 2025